PU Prime App

Exclusive deals on mobile

PU Prime App

Exclusive deals on mobile

Nắm giữ thị trường toàn cầu trong tay bạn

Ứng dụng di động giao dịch của chúng tôi tương thích với hầu hết các thiết bị thông minh. Tải xuống Ứng dụng ngay bây giờ và bắt đầu giao dịch với PU Prime trên mọi thiết bị, mọi lúc, mọi nơi.

The Biden-McCarthy meeting on the debt-limit bill has yet to yield any deal to avert a catastrophic U.S. default, with U.S. Treasury secretary warning that the country will run out of cash in June. Market sentiment worsened as the White House has no more meetings planned; and gold prices have rebounded due to heightened risk-off sentiment, which has also hit the equity markets. On the other hand, the New Zealand dollar slumped as the RBNZ signalled for ending its monetary tightening cycle and has a plan to cut rates next year. Conversely, the oil prices continued to rise in this week as the OPEC+ warned that it will reduce oil production to counter short-sellers.

Current rate hike bets on 14th June Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (70%) VS 25 bps (30%)

The US Dollar has witnessed a surge, buoyed by positive economic data. The latest report by Markit reveals that the US Services Purchasing Managers Index (PMI) recorded an impressive increase from 53.6 to 55.1, surpassing market expectations of 52.6. This upswing in the services sector indicates a strong rebound and adds to the growing optimism in the US economy. Furthermore, US New Home Sales displayed remarkable resilience, rising from 656K to 683K, surpassing expectations of 663K.

The Dollar Index is trading higher following the prior breakout above the previous resistance level. MACD has illustrated diminishing bearish momentum, while RSI is at 66, suggesting the index might extend its gains toward resistance level.

Resistance level: 104.20, 105.20

Support level: 102.30, 102.40

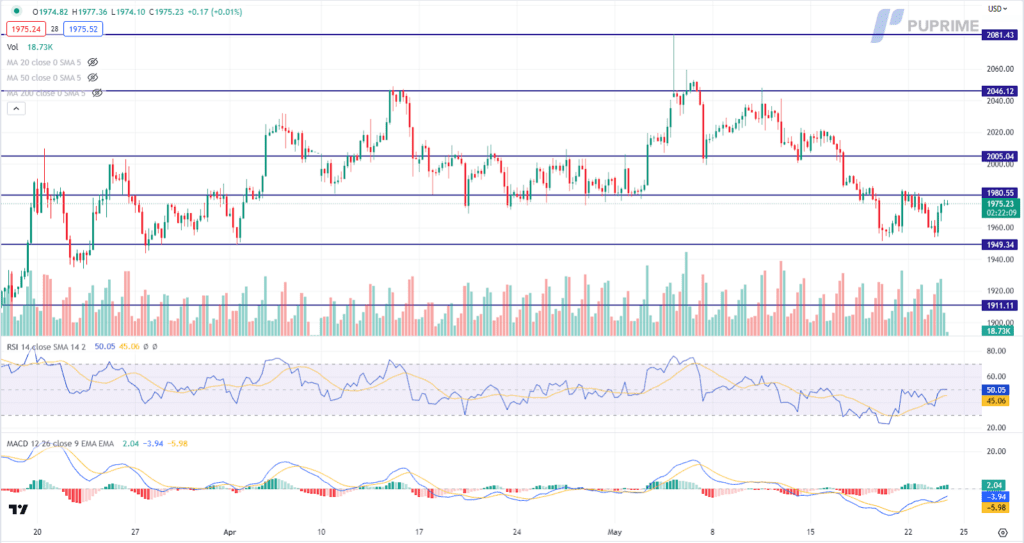

Gold prices rebounded on risk-off sentiment, with the gap remaining between House Republicans and the White House on the resolution of the looming debt ceiling deadline, according to the GOP negotiators. Investors fear that the lack of consensus on resolving the debt ceiling issue could trigger a ripple effect, causing significant disruptions to global financial stability. This anxiety has led to a cautious approach, sparking market demand on the safe-haven gold.

Gold prices are trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 50, suggesting the commodity will extend its gains after breakout since the RSI rebounded sharply from oversold territory.

Resistance level: 1980.00, 2005.00

Support level: 1950.00, 1910.00

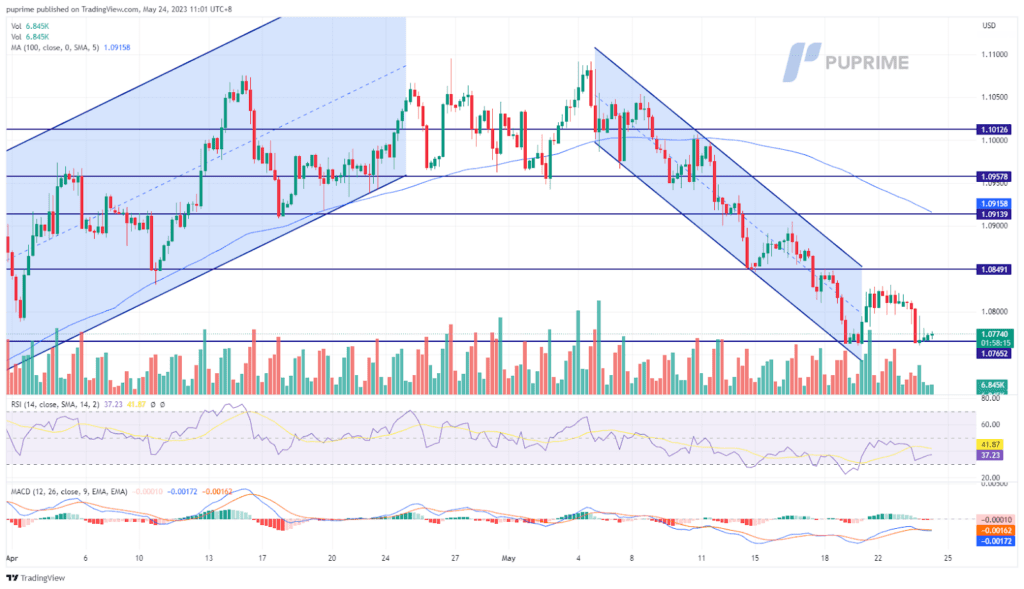

The dollar strength has eased after its bullish run since the start of the week. The White house has failed to yield any promising deal which increases the likelihood that the House and the Senate of the U.S. couldn’t vote on any deal in the coming week. The House Speaker added that there is no plan for further meetings after yesterday’s 2-hours meeting with the president. the risk-off sentiment has heightened where safe-haven gold rebounded while the dollar poised on the above. On the other hand, the Eurozone’s PMI showed that the region’s economy has signs of slowing down which increase the likelihood that the ECB will be more lenient in its monetary policy.

The euro has once again successfully rebounded on its crucial support level at 1.0765 and has formed a double bottom. The RSI is moving upward as the MACD flows flat below the zero line.

Resistance level: 1.0850, 1.0914

Support level: 1.0765, 1.0681

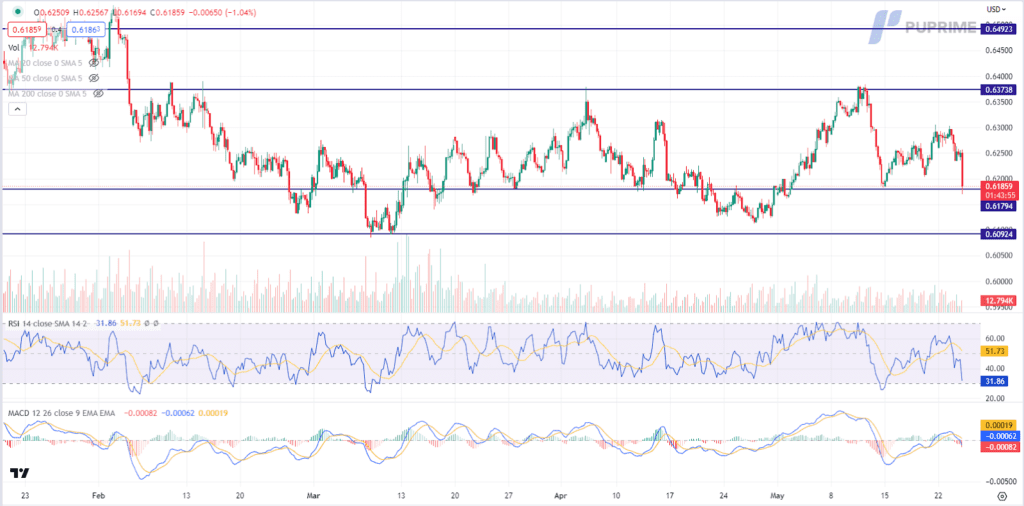

Despite the Reserve Bank of New Zealand’s decision to raise its Official Cash Rate (OCR) from 5.25% to 5.50%, the New Zealand Dollar experienced a dip in its value. According to officials, the central bank believes that maintaining a restrictive monetary policy is necessary to ensure stable inflation. However, the anticipation of weak global economic growth and easing inflationary pressures in the future have influenced this cautious approach. Domestically, New Zealand is expected to witness a decline in inflation due to sluggish consumer spending and a slowdown in residential construction activity. As a result, market participants are closely monitoring these factors to gauge the future trajectory of the New Zealand Dollar amidst this complex economic landscape.

NZD/USD is trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 32, suggesting the pair might extend its losses after breakout since the RSI stays below the midline.

Resistance level: 0.6375, 0.6490

Support level: 0.6180, 0.6090

On Tuesday, the pound experienced a decline as a result of disappointing UK economic data. The Composite Purchasing Managers’ Index (PMI), manufacturing PMI, and services PMI all fell below market expectations. This negative data suggests a slowdown in economic activity. Investors are advised to keep an eye on the upcoming release of UK Consumer Price Index (CPI) data later today, as it will provide further insights into the country’s inflationary pressures and may influence the pound’s movement in the near term.

While the upcoming UK CPI data is expected to impact the pound’s movement significantly, it is worth noting that from a technical standpoint, both the RSI and MACD indicators are signalling a weak momentum for the pound. These indicators suggest that the selling pressure on the pound may persist in the near term. Therefore, investors must consider the fundamental and technical factors before making any trading decisions related to the pound.

Resistance level: 1.2540, 1.2680

Support level: 1.2345, 1.2145

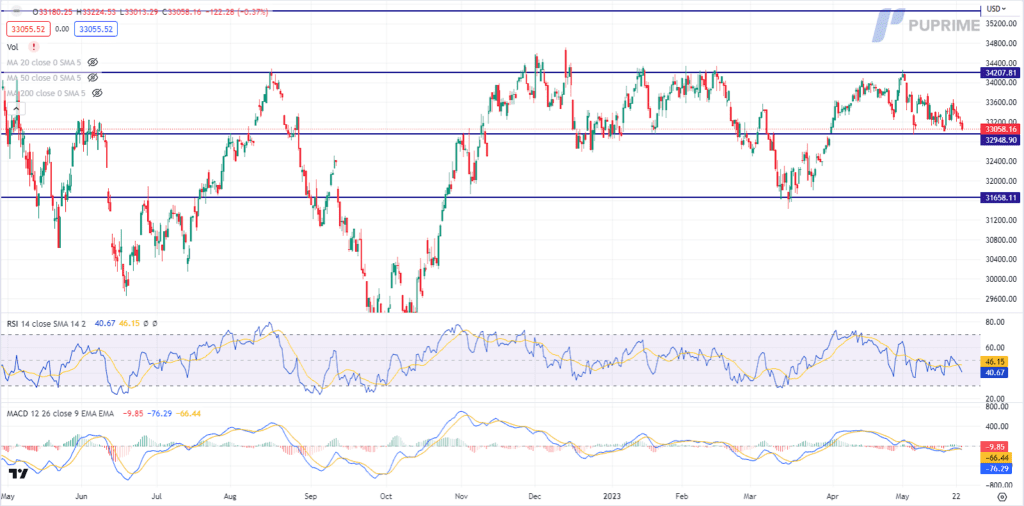

The Dow experienced a slight decline as investors sought shelter in safer investments. Gap remained between House Republicans and the White House on the resolution of the looming debt ceiling deadline, according to the GOP negotiators. Investors fear that the lack of consensus on resolving the debt ceiling issue could trigger a ripple effect, causing significant disruptions to global financial stability. This anxiety has led to a cautious approach, resulting in a retreat from riskier assets.

The Dow is trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 41, suggesting the index might extend its losses after breakout since the RSI stays below the midline.

Resistance level: 34210, 35450

Support level: 32950, 31660

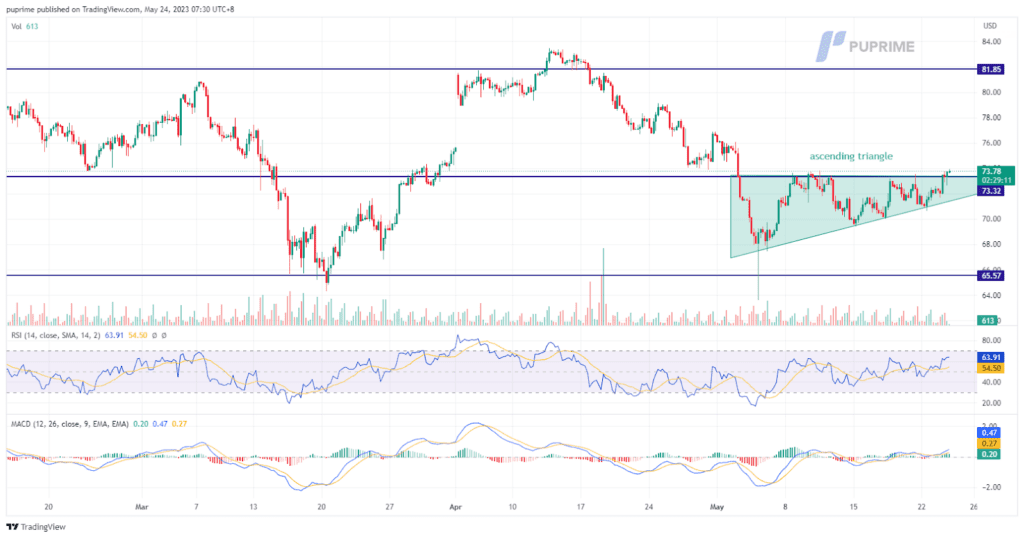

Oil prices rose 2.5% to $73.83 as U.S. gasoline supplies tightened, with inventories expected to decrease for the third consecutive week, reaching their lowest levels since 2014. This tightening supply has raised concerns about potential gasoline shortages and contributed to the recent increase in oil prices. Additionally, production cuts by certain OPEC+ members have taken effect, adding to concerns about potential supply constraints. The warning from Saudi Arabia’s energy minister to short sellers has further fueled the upward momentum in oil prices, as it signals a determination to protect prices and maintain stability in the market.

The oil price has successfully broken above the resistance level of the ascending triangle pattern, indicating a potential confirmation of the bullish trend. This breakout suggests a positive shift in momentum for oil prices, with the possibility of further upward movement.

Resistance level: 76.88, 81.85

Support level: 73.32, 65.57

Giao dịch ngoại hối, chỉ số, Kim loại,...với phí chênh lệch thấp trong ngành và khớp lệnh nhanh như chớp

Đăng ký Tài khoản Live PU Prime với quy trình đơn giản của chúng tôi

Dễ dàng nạp tiền vào tài khoản của bạn với nhiều kênh nạp tiền và loại tiền tệ được chấp nhận

Truy cập hàng trăm công cụ trong điều kiện giao dịch hàng đầu thị trường