Luôn cập nhật những tin tức và thông báo mới nhất của PU Prime.

PU Prime App

Exclusive deals on mobile

PU Prime App

Exclusive deals on mobile

Nắm giữ thị trường toàn cầu trong tay bạn

Ứng dụng di động giao dịch của chúng tôi tương thích với hầu hết các thiết bị thông minh. Tải xuống Ứng dụng ngay bây giờ và bắt đầu giao dịch với PU Prime trên mọi thiết bị, mọi lúc, mọi nơi.

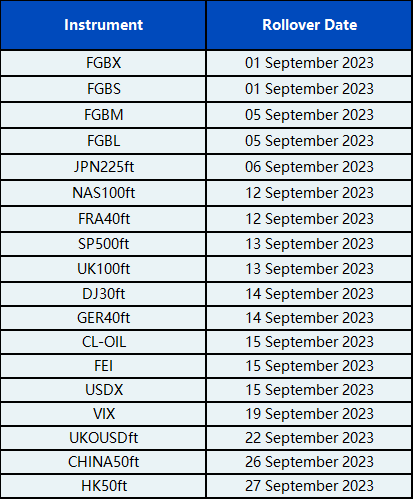

Dear Valued Client,

Please be advised that the following CFD instruments will be automatically rolled over as per the dates in the table below. As there can be a pricing difference between old and new futures contracts, we recommend clients to monitor their positions closely and manage positions accordingly.

Expiration dates:

*All hours are provided in GMT+3 (Server Time in MT4/MT5.)

Please note:

• The rollover will be automatic, and any existing open positions will remain open.

• Positions that are open on the expiration date will be adjusted via a rollover charge or credit to reflect the price difference between the expiring and new contracts.

• To avoid CFD rollovers, clients can choose to close any open CFD positions prior to the expiration date.

• Clients should ensure that take profits and stop losses are adjusted before this rollover occurs.

If you have any questions or require any assistance, please contact our Customer Care Team via Live Chat, email: info@puprime.com, or phone +248 4373 105.

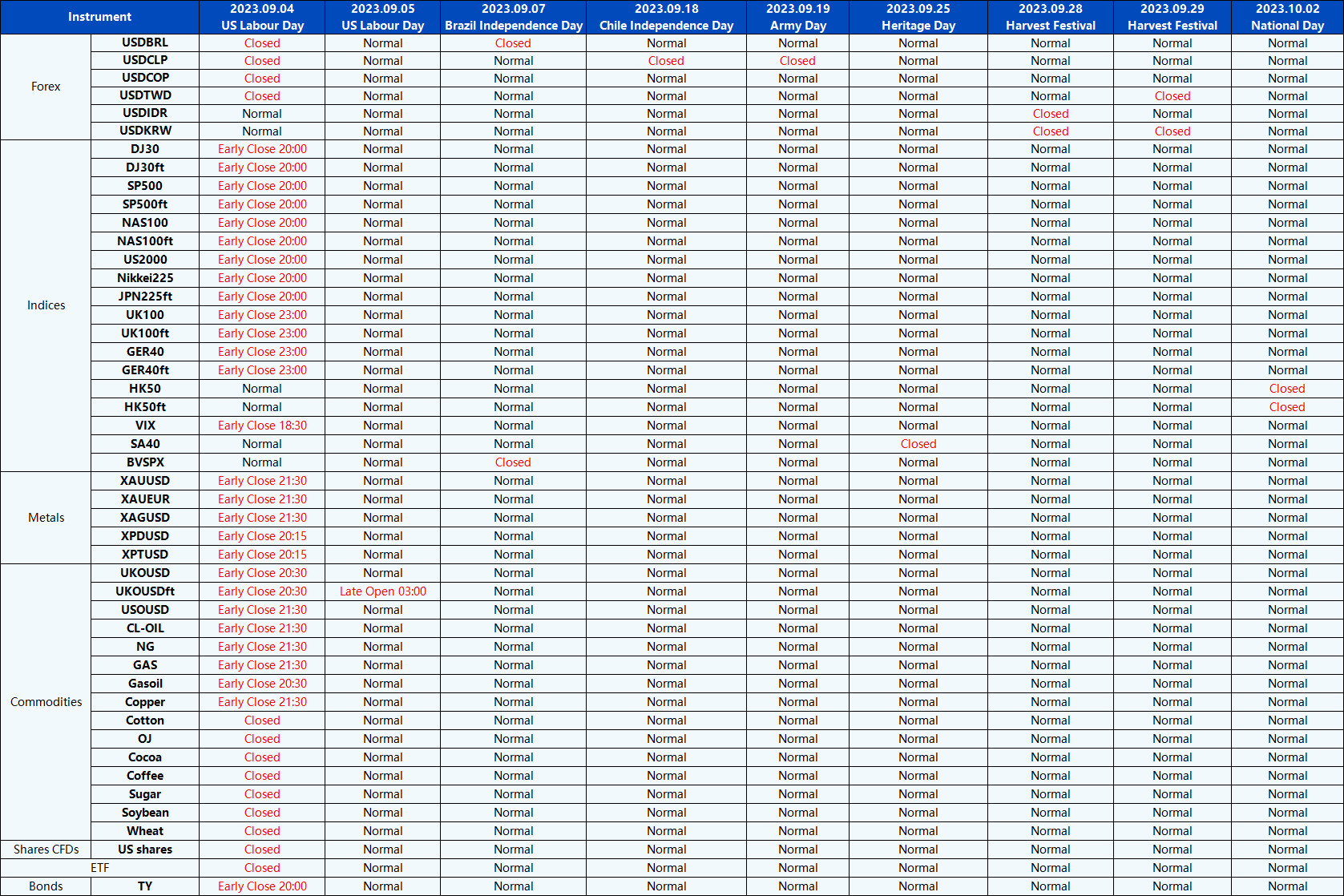

Dear Valued Client,

Please be advised that the following instruments’ trading hours and market session times will be affected by the upcoming September holidays.

Please refer to the table below outlining the affected instruments:

* All hours are provided in GMT+3 (Server Time in MT4/MT5.)

Please note that in the event of reduced liquidity in the market, spreads might significantly increase from their normal average level.

If you have any questions or require any assistance, please contact our support team via Live Chat or email: info@puprime.com or phone +248 4373 105.

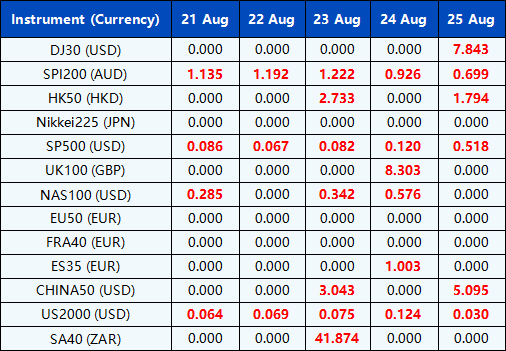

Dear Valued Client,

Please be advised that the dividends of the following index CFDs will be adjusted by upcoming ex-dividend dates. The comment for trading index CFDs will be in the following format “Div&<Product Name>&<Net Volume>” which show in the balance after the close of the day before the dividend payment date.

Please refer to the table below for more details:

*All dates are provided in GMT+3 (Server Time in MT4/MT5.)

Please note the above data are subject to changes. Please refer to MT4/MT5 for details.

If you have any questions or require any assistance, please contact our Customer Care Team via Live Chat, email: info@puprime.com or phone +248 4373 105.

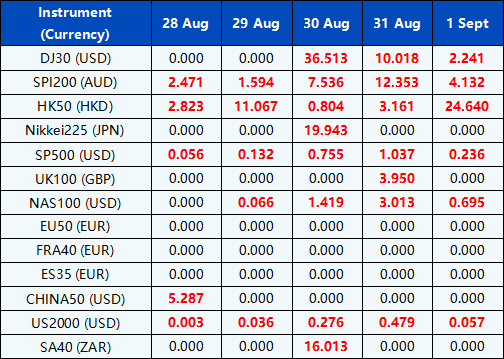

Dear Valued Client,

Please be advised that the dividends of the following index CFDs will be adjusted by upcoming ex-dividend dates. The comment for trading index CFDs will be in the following format “Div&<Product Name>&<Net Volume>” which show in the balance after the close of the day before the dividend payment date.

Please refer to the table below for more details:

*All dates are provided in GMT+3 (Server Time in MT4/MT5.)

Please note the above data are subject to changes. Please refer to MT4/MT5 for details.

If you have any questions or require any assistance, please contact our Customer Care Team via Live Chat, email: info@puprime.com or phone +248 4373 105.

Dear Valued Client,

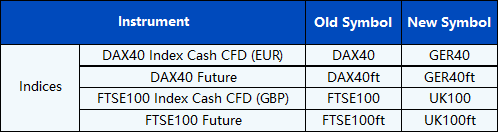

PU Prime will update the symbol of Indices CFDs products effective from 4th September 2023.

Kindly refer to the table below outlining the affected instruments:

Please note the above data are subject to changes. Kindly refer to MT4/MT5 for details.

Important Note:• Live Account: For clients with open positions for the abovementioned Indices CFDs after the market closes on 1st September 2023 would have the symbol updated on 4th September 2023. This update will not impact the product specifications, the prices of existing open positions or pending positions or any result in the closure of positions. • Demo Account: All open and pending orders associated for the abovementioned Indices CFDs after the market closes on 1st September 2023 in Demo Account would be force closed.

If you have any questions or require any assistance, please contact our Customer Care Team via Live Chat, email: info@puprime.com or phone +248 4373 105.

Dear Valued Client,

Please be advised of the upcoming Sempra Energy (SRE) stock split that is going to take place as per the following schedule:

• Ex-Date: August 22th, 2023 (GMT+3, MT4/MT5 server time). Common shares will trade at the new split-adjusted price.

The primary motive is to make the shares more affordable to small investors even though the underlying value of the company has not changed. SRE would like its stock to be more accessible to a broader base of investors.

Important notes of the SRE Stock Split

• The number of shares of each client’s position will multiply by 2.

• Post-split, the open price of each position will be adjusted, which will be the original price divided by 2.

• All pending orders at the time of the split (Buy Limit, Sell Limit, Buy Stop, Sell Stop,Buy Stop Limit and Sell Stop Limit) will be deleted.

Please note that:

• The following orders for SRE shares will be deleted due to the stock split:

Live Account: Pending orders (At time of stock split)

Demo Account: All open and pending orders

• All settings of Stop Loss and Take Profit on Live account SRE open position will be ADJUSTED to the original setting price divided by 5.

Example:

Investor current has an open SRE position of 100 shares at the price of USD 1000 with a Take Profit (TP) of USD 500.

After the Stock split of 5 for 1: (Adjustment done would be as follows)

Position Price: USD 500 (USD 1000/2)

Take Profit (TP): USD 250 (USD 500/5)

If you have any questions or require any assistance, please contact our Customer Care Team via Live Chat, email:info@puprime.com, or phone +248 4373 105.