PU Prime App

Exclusive deals on mobile

PU Prime App

Exclusive deals on mobile

Nắm giữ thị trường toàn cầu trong tay bạn

Ứng dụng di động giao dịch của chúng tôi tương thích với hầu hết các thiết bị thông minh. Tải xuống Ứng dụng ngay bây giờ và bắt đầu giao dịch với PU Prime trên mọi thiết bị, mọi lúc, mọi nơi.

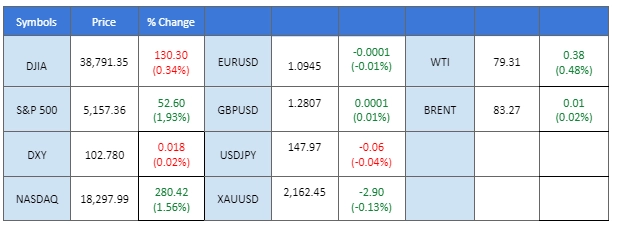

* The dollar Index (DXY) continues to plunge due to persistent dovish messages from Jerome Powell.

* Gold prices continue to break their all-time high level and currently face strong resistance at the $2160 mark.

* BTC has rebounded and is back to $67000 territory.

The dollar is currently experiencing downward pressure, a reaction to signals of an imminent shift in the Federal Reserve’s monetary policy. Federal Reserve Chair Jerome Powell’s recent testimony underscored his confidence that U.S. inflation is on track to meet the central bank’s target rate. Meanwhile, gold prices have soared to an all-time high, reaching the $2160 mark, largely fueled by the weakening dollar.

On another front, the European Central Bank (ECB) has held its interest rates steady, a decision that met market expectations. This maintenance of current rates, alongside the prospect of a diverging monetary policy path from the Fed, has contributed to bolstering the euro’s strength against the dollar. Moreover, Bitcoin (BTC) has managed to reclaim its territory in the $67,000 range after undergoing a significant drop on Tuesday. This fluctuation in BTC’s value can be attributed to a strong profit-taking sentiment that temporarily overpowered the bullish momentum within the crypto market.

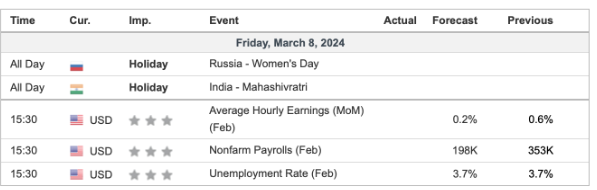

Current rate hike bets on 20th March Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (95%) VS -25 bps (5%)

(MT4 System Time)

Source: MQL5

The Dollar Index has undergone a substantial decline for a second consecutive session. This can be attributed to the messaging from the Federal Reserve chief during the testimony, indicating that the U.S. central bank is approaching its targeted inflation rate of 2%, and the Fed is on the verge of adjusting its monetary tightening policy. This development has heightened speculation about a potential rate cut in June, significantly impacting the strength of the dollar, causing it to depreciate.

The dollar index has broken another support level, suggesting the dollar is trading with strong bearish momentum. The RSI has broken into the oversold zone, while the MACD is moving lower and diverging, suggesting the bearish momentum is gaining.

Resistance level: 103.70, 104.50

Support level: 102.00, 101.35

Gold prices are sustaining their bullish rally and are currently testing another resistance level at the $2160 mark. The surge in gold prices is primarily attributed to the weakening of the dollar, influenced by the dovish message delivered by Jerome Powell during the testimony. However, the prevailing optimism in equity markets and the cryptocurrency market suggests a growing risk appetite among traders, which could potentially limit the continued rally of gold.

Gold prices have been trading with strong bullish momentum but are currently held at near $2160, another resistance level. The RSI remains in the overbought zone this week, while the MACD flows flat at elevated levels, suggesting the bullish momentum is easing.

Resistance level:2190.00, 2210.00

Support level: 2140.00, 2117.90

GBP/USD made significant gains buoyed by optimism surrounding the UK’s budget announcement. Chancellor of the Exchequer, Jeremy Hunt, revealed positive forecasts from the Office for Budget Responsibility (OBR), anticipating a 0.80% economic growth in 2024 — 0.50% higher than the previous autumn forecast. Hunt announced a tax rate cut in employees’ National Insurance from 10% to 8%, signalling further confidence in the economic trajectory. Despite the tax cut, Hunt expressed assurance that the UK’s debt level would stabilise and projected a gradual reduction to 94.3% by 2028-29, down from the current level above 100%.

GBP/USD is trading higher following the prior breakout above the previous resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 78, suggesting the pair might experience technical correction since the RSI retreated sharply from overbought territory.

Resistance level:1.2905, 1.3000

Support level: 1.2785, 1.2710

EUR/USD pair extended its gains, reaching multi-week highs amidst heightened selling pressure on the US Dollar. The weakened greenback was fuelled by disappointing readings from the US labor market, creating a favourable environment for the Euro. Despite the European Central Bank’s (ECB) overall dovish stance, the momentum of the EUR/USD pair remained unaffected, as demand for the Dollar continued to wane. The ECB’s outlook included a 1.5% growth projection for the European economy in 2025 and 1.60% in 2026, driven by robust consumption and investment.

EUR/USD is trading higher while currently testing the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 71, suggesting the pair might enter overbought territory.

Resistance level: 1.0965, 1.1040

Support level: 1.0865, 1.0770

The Canadian Dollar experienced a notable resurgence as the market absorbed the hawkish sentiments emanating from the Bank of Canada. In its most recent monetary policy decisions, the BoC opted to maintain its interest rates at 5%, with the Bank rate and deposit rate held at 5.25% and 5%, respectively. The central bank affirmed its commitment to quantitative tightening, citing Canada’s robust economic performance compared to other major regions.

USD/CAD is trading lower while currently testing the support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 24, suggesting the pair might enter oversold territory.

Resistance level: 1.3535, 1.3620

Support level: 1.3450, 1.3345

The Japanese Yen continued its upward trajectory, supported by reports indicating growing confidence among Bank of Japan (BoJ) officials in the country’s potential for sustainable wage growth and achieving a stable 2% inflation rate. This newfound confidence has stirred speculation among market participants that the BoJ may adjust its monetary policy, potentially in March. The anticipated shift raises the prospect of the BoJ moving away from maintaining the world’s last negative interest rate, signalling a significant development in Japan’s monetary landscape.

USD/JPY is trading lower while currently testing the support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 24, suggesting the pair might enter oversold territory.

Resistance level: 149.40, 150.80

Support level: 147.60, 146.35

Following a brief pause from the previous AI-driven rally, the U.S. equity markets, including the Nasdaq, have resumed their upward trajectory, reclaiming all-time high levels. The resurgence is accompanied by a growing risk appetite in the market. Federal Reserve Chair Jerome Powell has consistently communicated a dovish stance in his testimony, indicating that the Fed is nearing a point where changes to its monetary policy may be on the horizon. This dovish tone appears to be favouring riskier assets, particularly the equity market, leading to renewed investor confidence and a return to record highs.

Nasdaq has gotten back to its all-time high levels, suggesting the index remains trading with bullish momentum. The RSI remains flowing close to the middle region, while the MACD hovers above the zero line, suggesting bullish momentum is slowly forming.

Resistance level: 18970.00, 19320.00

Support level: 17800.00, 17390.00

Oil prices have faced challenges in sustaining upward momentum, despite factors that traditionally might boost prices, such as the easing strength of the dollar and potential dovish policy shifts from the Federal Reserve. However, there was a slight rebound in oil prices in the latest trading session, attributable to a temporary supply disruption. A critical pipeline, which facilitates the transport of oil from Canada to the U.S., experienced a temporary shutdown, causing a brief uptick in prices due to the immediate impact on supply.

Oil prices have found support at their crucial liquidity zone at near $78.70. The RSI hovering near the 50 level while the MACD flowing flat close to the zero line suggests a neutral signal for oil.

Resistance level: 81.20, 84.10

Support level: 78.65, 75.20

Giao dịch ngoại hối, chỉ số, Kim loại,...với phí chênh lệch thấp trong ngành và khớp lệnh nhanh như chớp

Đăng ký Tài khoản Live PU Prime với quy trình đơn giản của chúng tôi

Dễ dàng nạp tiền vào tài khoản của bạn với nhiều kênh nạp tiền và loại tiền tệ được chấp nhận

Truy cập hàng trăm công cụ trong điều kiện giao dịch hàng đầu thị trường