PU Prime App

Exclusive deals on mobile

PU Prime App

Exclusive deals on mobile

Nắm giữ thị trường toàn cầu trong tay bạn

Ứng dụng di động giao dịch của chúng tôi tương thích với hầu hết các thiết bị thông minh. Tải xuống Ứng dụng ngay bây giờ và bắt đầu giao dịch với PU Prime trên mọi thiết bị, mọi lúc, mọi nơi.

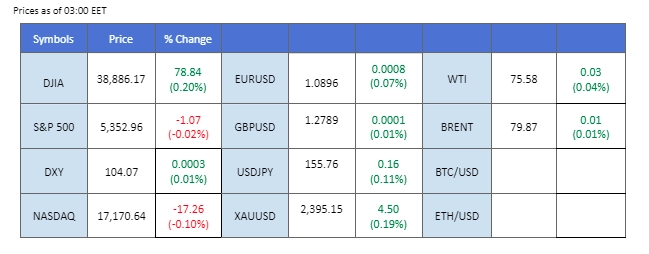

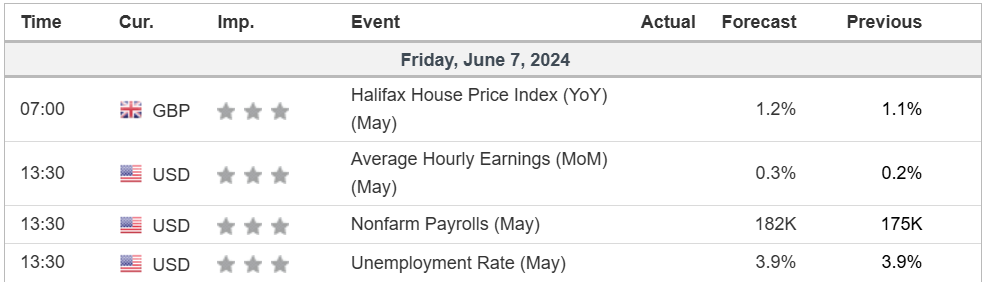

All eyes are on today’s Nonfarm Payroll (NFP) and U.S. unemployment rate data, which could be the final piece of the puzzle for the Federal Reserve’s rate cut decision this year. Recent lackluster U.S. economic indicators, alongside monetary policy pivots from the Bank of Canada (BoC) and the European Central Bank (ECB), may pressure the Fed to follow suit.

Ahead of the crucial job data, U.S. equity markets are poised at their recent high levels, while the dollar index (DXY) is struggling just above the 104 mark. In the eurozone, despite the ECB’s 25 basis points rate cut yesterday, the impact was minimal as the decision was already priced in by the market.

In the commodity markets, gold prices have surged on the back of the softened dollar, breaking out of a week-long range to rise above $2370. Meanwhile, oil prices are holding at recent highs, with OPEC+ officials indicating that member states will adjust supply as necessary even when the supply cut policy phased out in the 4th quarter this year.

Current rate hike bets on 12nd June Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (98.9%) VS -25 bps (1.1%)

(MT4 System Time)

Source: MQL5

The Dollar Index, which measures the greenback against a basket of six major currencies, extended its losses as US Treasury yields tumbled. Investors speculated that the Federal Reserve might consider cutting interest rates following recent disappointing economic data. All eyes are on today’s Nonfarm Payrolls and Unemployment rate data for further trading signals. While the Federal Reserve is expected to maintain its current rates at next week’s meeting, several economists suggest that rate cuts could begin in September, citing the recent downbeat economic performance.

The Dollar Index is trading lower while currently testing the support level. MACD has illustrated diminishing bullish momentum, while RSI is at 43, suggesting the index might extend its losses after breakout the support level.

Resistance level: 104.70, 105.15

Support level: 104.10, 103.65

Gold prices continued to rise, driven by recession fears and expectations of easing monetary policies from major central banks. The recent rate cut by the European Central Bank has fueled speculation that the Federal Reserve might follow suit, given the underwhelming US economic performance. Although the Fed is likely to maintain its rates next week, investor scepticism persists regarding its long-term approach. Declining US Treasury yields and expectations of a September rate cut could increase money supply and liquidity, boosting demand for gold.

Gold prices are trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 67, suggesting the commodity might extend its gains after breakout since the RSI stays above the midline.

Resistance level: 2380.00, 2410.00

Support level: 2350.00, 2315.00

The GBP/USD pair is trading sideways at recent high levels as markets await the crucial Nonfarm Payroll (NFP) data due later today. The U.S. job data is expected to directly impact the Federal Reserve’s interest rate decision, scheduled to be announced next week. Meanwhile, with the U.K.’s CPI remaining above 3%, it is anticipated that the Bank of England (BoE) will maintain its hawkish monetary policy stance for an extended period to curb inflation. This expectation could fuel Sterling’s strength, supporting the GBP/USD pair.

GBP/USD is poised at its recent high level while the bullish momentum seemingly eases. The RSI is flowing flat near the 50 level, while the MACD is hovering flat at the elevated level.

Resistance level: 1.2850, 1.2940

Support level: 1.2760, 1.2660

The Euro remained flat even after the European Central Bank (ECB) cut its interest rates for the first time since 2019. The ECB’s decision came as inflation dropped from 10% in 2022 to the recent 2% target, coupled with lacklustre economic performance, which provided room for further rate cuts to stimulate the economy. The ECB emphasised that future monetary policy will remain data-dependent and will be determined on a meeting-by-meeting basis to set the appropriate level and duration of restrictions.

EUR/USD is trading higher following the prior rebound from the support level. MACD has illustrated increasing bullish momentum, while RSI is at 59, suggesting the pair might extend its gains toward resistance level since the RSI stays above the midline.

Resistance level: 1.0925, 1.1010

Support level: 1.0865, 1.0805

The Dow eked out marginal gains in the last session as the market awaits today’s crucial Nonfarm Payroll (NFP) and unemployment rate data. A soft reading for both job metrics would increase the likelihood of the Federal Reserve pivoting its monetary policy next week. Such a dovish shift would likely encourage the equity market, leading to higher trading levels driven by the prospect of lower interest rates.

The Dow continues to trade higher after it recorded a technical rebound, suggesting a potential trend reversal for the index. The RSI is gradually moving upward, while the MACD is on the brink of breaking above the zero line, suggesting bullish momentum may be forming.

Resistance level: 39140.00, 39900.00

Support level: 38570.00, 37810.00

The USD/JPY pair traded sideways as the market awaits crucial U.S. job data. If the job data comes in soft later today, it could push the pair lower due to the increased likelihood of a dovish pivot from the Federal Reserve. Meanwhile, a sharp drop in Japanese holdings of foreign assets in May indicates that the Japanese government now holds ample reserves, potentially enabling it to intervene in the market to support the yen.

The USD/JPY has rebounded from its plummet but kept below the Fibonacci level of 61.8%, suggesting the pair remains trading within its bearish trajectory. The RSI hovers flat at the 50 level while the MACD moves toward the zero line from below, suggesting the bearish momentum is easing.

Resistance level: 156.00, 157.40

Support level: 154.80, 153.80

Crude oil prices rebounded, supported by the depreciation of the US Dollar and expectations of easing monetary policies from global central banks. Typically, rate cuts are seen as stimulative for economic growth, potentially boosting future oil demand. Additionally, OPEC+’s decision to extend voluntary production cuts provides further bullish momentum for the oil market. However, despite the short-term rebound, the longer-term outlook for oil remains uncertain due to ongoing economic instability. Investors should continue to monitor developments for further trading signals.

Oil prices are trading higher following the prior rebound from the support level. MACD has illustrated increasing bullish momentum, while RSI is at 57, suggesting the commodity might extend its gains toward resistance level since the RSI rebounded sharply from oversold territory.

Resistance level: 76.15, 79.80

Support level: 72.90, 70.15

Giao dịch ngoại hối, chỉ số, Kim loại,...với phí chênh lệch thấp trong ngành và khớp lệnh nhanh như chớp

Đăng ký Tài khoản Live PU Prime với quy trình đơn giản của chúng tôi

Dễ dàng nạp tiền vào tài khoản của bạn với nhiều kênh nạp tiền và loại tiền tệ được chấp nhận

Truy cập hàng trăm công cụ trong điều kiện giao dịch hàng đầu thị trường